I was viewing a site on my blog roll (

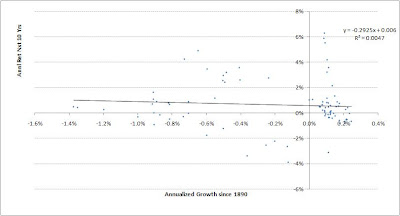

http://www.multpl.com/) the other day and thought it might be worthwhile to run some trend analysis on the inflation adjusted monthly S&P 500 data going back to 1880, which you can download there. The charts above reveal some interesting findings.

In the first chart, viewed over the past 130 years on a logarithmic scale, the growth of the S&P 500 appears relatively stable around the black trend line. The black trend line is a least-squares regression based on the exponential growth equation y=b*m^x, where x=month, m=coefficient that provides the best fit, and b=constant that provides the best fit. For example, Feb-2011 is the 1,563rd month of the data series, so x=1,563. The best-fit coefficient (m) is 1.001428. The best-fit constant (b) is 95.34. So the result (y) = 95.34*1.001428^1,563 = 886. So 886 is where the black trend line ends up at the right hand side of the chart.

The black trend line of course was regressed using all the data from 1880 to 2011. However, if one was to have traded based on this metric at any point in the past, then of course they would have only had data up until that date. Therefore, the blue line shows where the black trend line would have ended up if calculated each month in the past. For example, in Jan-1900, the black trend line based solely on data from 1880-1900, would have ended up at 165, which is what is shown by the blue line.

Now, if someone had calculated the black trend line in Jan-1900 and derived an end result of 165, they also would have seen the S&P 500 actually was 170 then, so the close(170) / trend(165) equaled 1.03. In other words, at that time, based solely on trend analysis, the market seemed to be at a normal level.

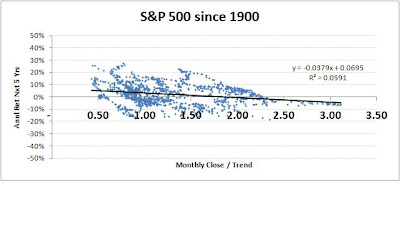

The second chart above shows a scatter comparison of this close/trend metric vs. returns achieved by the S&P 500 over the subsequent year. As you can see, there is a wide dispersion with lots of noise and very little signal. This jives with the stock market being a mostly unpredictable system.

The third chart shows a scatter comparison of the close/trend metric vs. annualized returns over the subsequent five years. There is a bit tighter relationship, but still mostly noise.

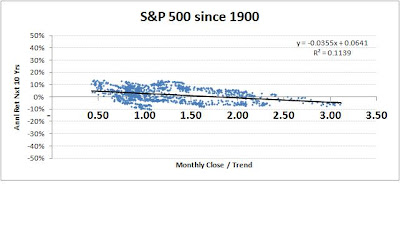

The fourth chart shows annualized returns over the subsequent ten years. Here the relationship is noticeably tighter, but the R^2 is still only 11%.

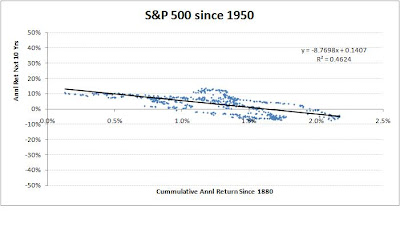

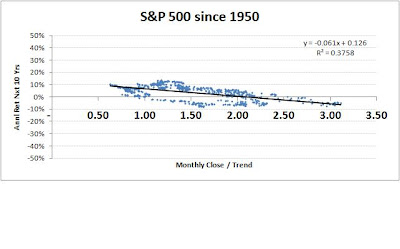

The fifth and last chart is interesting. It shows returns over the subsequent ten years, but the data is just since 1950. So each month the trend line is calculated, it's based on at least 70 years of data (1880-1950) and at the end is based on 120 years of data (1880-2000). Here the relationship is even tighter, with R^2=37%. In some fields, 37% isn't very impressive, but when speaking of a system as random as the stock market, it indicates a relatively strong signal.

So the line of best fit drawn through the last scatter chart has an equation of y = -0.061x+0.126, where x=close/trend. This means, if close/trend = 1.0, then the expected annualized return over the subsequent ten years (y) is 6.5% (inflation adjusted). If close/trend = 2.0, then the expected return would be 0.4%.

Where do we stand now? Well, as of 2/25/11, the S&P 500 closed at 1,320 and the black trend line was at 886, so close/trend was 1.49. Therefore, solely based on this trend analysis, the projected annualized return over the next ten years is 3.5% (inflation adjusted). The standard error of the regression is 4.45%, so the 90% confidence interval is 3.5% +/- 1.65*4.45%, which provides a range of -3.8% to 10.9%. Not very helpful, right? That's the nature of the stock market. All we can say is that when the market is priced substantially above trend, there is a tendency for subsequent returns to be sub par. For grins, the 50% confidence interval for annualized returns over than next ten years is a range of 0.5% to 6.5% (inflation adjusted).