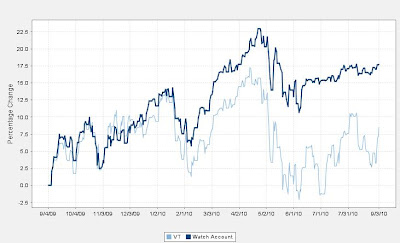

Between reading loan documents for work and preparing for my fantasy football draft on Monday, I won't be doing a real post this weekend. However, the charts above show the model portfolio performance after the completion of one full year of history.

As a recap, from 9/2009 thru 4/2010, the model portfolio slowly but steadily got out to a lead over the benchmarks, in my opinion due mainly to the low beta stock selection, economic sector diversification, and minimization of financial sector exposure. From 4/2010 thru 6/2010 I pruned the portfolio to lower the beta even more and allocated 1/3 to low beta foreign stocks in an effort to further lower the covariance with the S&P 500. In 6/2010, I turned bearish based on the weakening economic fundamentals, mainly retail sales, and allocated 1/3 of the portfolio to the ETF that moves inversely to the S&P 500 (ticker: SH). Since then, the portfolio volatility has been very low while the equity markets as a whole have essentially been unchanged from then to now, but with a lot more volatility along the way.

Overall, I am pleased with the results, while realizing this could well be 100% luck. The markets are so volatile in comparison to the magnitude of the model portfolio outperformance, that one could reasonably attribute this outperformance to statistical noise. As I told my son last month while explaining the basics of investing to him, one should try to select an advisor that can demonstrate this type of outperformance consistently over say 10 years. Further, even such a track record of outperforming 9 of 10 years would be insufficient if the one year of underperformance is so awful as to make the cumulative return lag the market benchmark. Still, if an advisor is found who can truly meet this standard, it could still be luck, but intuitively I believe such a track record would provide for a better chance of outperformance in coming years as compared to an advisor without such a record.

Otherwise, if one can only find advisors for whom the prospect of outperformance is essentially a gamble, why not save the management expense and gamble on your own? I don't mean go crazy and put 100% of your savings into the latest hot stock, but I do think most folks would do well to (i) minimize their management expenses via a low cost platform like folioinvesting.com and (ii) minimize portfolio volatility via sector diversification, geographic diversification, and low beta stock selection. For the technically inclined, disciplined market timing strategies based on quantitative rules can help minimize portfolio volatility as well.