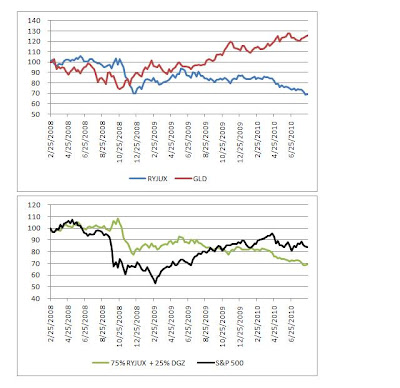

I was thinking about the disconnect between gold prices and government bond prices as they pertain to inflation expectations. Gold prices are high presumably due to expectations of increased inflation. However, government bond prices are high (i.e. interest rates are low) presumably due to expectations of low inflation if not outright deflation. The first chart above illustrates this disconnect as represented by the ETF that tracks the inverse of the 30-year Treasury bond (ticker: RYJUX) and the ETF that tracks gold prices (ticker: GLD). As you can see, the spread between the two is relatively wide now. In the simplest terms, if I want to try profiting from this disconnect, I might consider (i) buying the ETF that moves inversely to the price of gold (ticker: DGZ) and (ii) buying RYJUX.

Such a combination would reflect my personal expectation that inflation reality will play out somewhere in between the two aforementioned sets of expectations. Helicopter Ben Bernanke will neuter deflation by increasing the base money supply via quantitative easing, thereby sufficiently offsetting the decline in credit / velocity of money. The resulting increased inflation (or lack of deflation) will raise nominal interest rates, thereby decreasing bond prices and increasing the price of RYJUX. However, since inflation probably will not get out of hand and I think this outlook will eventually become widespread, it will cause the price of gold to decline, thereby increasing the price of DGZ. If I'm wrong and inflation gets out of hand, then losses from DGZ should be more than offset by gains from RYJUX.

So there are three scenarios:

1. If there is moderate inflation (my expectation), then this trading setup should do well.

2. If there is hyperinflation, this trading setup should do just OK.

3. If there is deflation, this setup is most likely a looser.

I might consider solely buying RYJUX, but then it's possible that increased inflation expectations could be offset by lower real interest rates, thus leaving nominal interest rates unchanged, thus leaving the price of RYJUX unchanged. Meanwhile I would miss out on the likely rise in DGZ resulting from the moderate (not hyper) inflation.

UPDATE: The fly in the ointment here could be the method of quantitative easing. For instance, if the Fed keeps the treasury bond prices artificially high by purchasing them with newly created money, then you could in fact end up with the counterintuitive scenario of continued low interest rates on treasury bonds and high inflation, in which case the trade outlined above would be a bust until the quantitative easing abates. In other words, the Fed could seriously distort the connections between market expectations of inflation and treasury interest rates. However, the Fed could implement quantitative easing by purchasing financial assets other than treasuries, such as mortgage bonds, in which case the trade would likely work out well.

Technical notes:

1. The charts only go back to the start of 2008 because that's when the DGZ ETF was originated.

2. The allocations between RYJUX and DGZ are 75% and 25%, respectively, because DGZ is more volatile and those proportions help minimize the overall volatility of the setup.

3. To be precise, 30-year government bond prices may be high primarily due to technical factors such as 'flight to safety', rather than expectations of low inflation or deflation and the associated low short-term interest rates during the foreseeable future, but the distinction shouldn't impact the above analysis.

Quote for the Week: "Envy reflects our values by showing us not just what we want, but also what we would do to get what we want...because we're envious only of people who make their money in ways that we condone. We envy people for getting what we want in ways we can imagine. The more distant the possibility of achieving a certain kind of success, the weaker the envy. How can you control your envy? The same way you control all your emotions: by changing your beliefs. Convince yourself...that your life will not be essentially improved by a new patio, and you'll no longer envy your neighbor's new addition to his house. When you change your values, you change your emotions...success depends in part on understanding how our evaluations direct our emotions. To gain that understanding, we need to do a bit of philosophical analysis. -Joshua Halberstam, author of Everyday Ethics, copyright 1993.