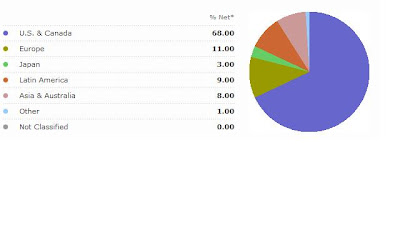

The charts above are created by morningstar.com as a feature of their premium membership offering. As you can see, the 100 stocks provide for a well diversified portfolio by economic sector, market cap, and geography. In fact, I would go so far as to say this equal-weighted porfolio is more diversified than the S&P500, which is market-cap weighted.

The average beta of this portfolio is 0.69x, which means in any short run time period, it should zig and zag with a magnitude about equal to 69% of the S&P500. In the long run, as the small short-run deviations accumulate, I'm expecting the portfolio to out-perform the S&P500 and also out-perform my true benchmark, which is the Vanguard Global Stock ETF (ticker: VT).

The portfolio is tilted towards stocks with valuation ratios (price/earnings, etc) lower than the S&P500 and growth prospects (earnings growth projections) greater than the S&P500. The benefit of investing in companies with decent growth prospects, rather than solely low valuation ratios is that it helps one avoid companies that are cheap for a reason that have increased risk of bankruptcy. It's a nod to the value investors' philosophy of buying companies with decent business prospects at a cheap price.

Lastly, the first chart above is a back-test showing how this portfolio would have performed against the S&P500 over the past five years. This is only an indication and isn't definitive because some of the 100 stocks haven't been around five years, which is indicated by the dotted line for the first portion of the time period.

Note: In order to view the chart above showing the 100 stock holdings, or any of the other charts, click the image twice for a larger version.