It has now been exactly 15 months since I established the model portfolio 9/4/09. There have been changes along the way, as I tried my hand at a little market timing from June-November with a market-neutral portfolio. Although the hedge used was the ETF that moves inversely to the S&P500, which left the portfolio somewhat exposed to foreign currency movements vis-a-vis the dollar and small cap stocks vis-a-vis large cap stocks. The portfolio has also evolved as I've continually pruned it from roughly 700 stocks down to 169 stocks. This was mainly done by eliminating all but the lowest beta stocks. This week I've culled the portfolio down to 100 stocks by eliminating some of the pricier names, thereby increasing the tilt towards value stocks.

My intention is to hold these 100 stocks throughout 2011. Furthermore, I'm going to fund my account at folioinvesting.com and henceforth report the results from my real portfolio, rather than a model (paper) portfolio.

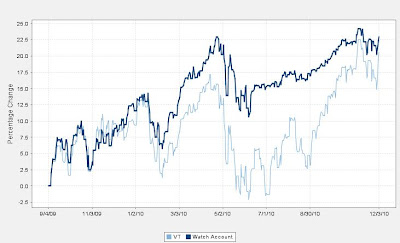

The next post will provide a summary of the 100 stocks, but before getting to that, I've posted for the record the results of the model portfolio over the past 15 months (see charts above). Nothing stellar, but not bad. Essentially, total return was in line with the overall market, but the pathway of getting there was less stomach-churning than the overall market, so if you had been invested like the model, there was less chance you would panic and sell out at the bottom. I mention this because most investors fall short of matching the overall market for this very reason, which is why in some ways, I think the volatility of one's portfolio is an important determinant of realized returns.